Predictions of the demise of packaging distributors apparently are quite premature. That’s the major conclusion of an exclusive invitation-only reader survey conducted by Packaging World in April. However, the survey does show that many end users are moving toward more direct buying from manufacturers and away from distributors.

The results also point to an increasingly prominent role for the Internet in researching new packaging materials and machinery. At the same time, a high percentage of readers say their companies don’t buy or even reorder packaging materials via the Internet. And these results cut a wide swath across industries and company sizes (see sidebar, “Survey participants,” p. 89).

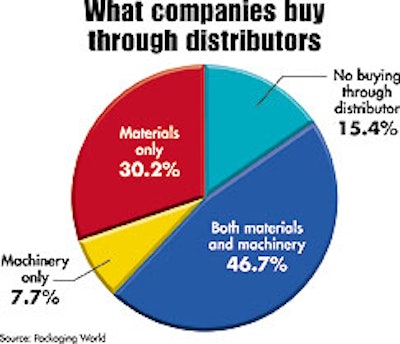

Overall, 182 readers participated in the survey. Of the total, just 15.4% reported that their companies bought neither materials nor machinery through distributors (see Chart 1). In fact, nearly 47% of respondents said their companies had bought both materials and machinery via distributors. Of the balance, respondents said their companies were four times as likely to purchase materials vs machinery through distributors.

As strong as these results are for packaging distributors, the trend for the future isn’t quite as positive. Nearly 46% of respondents reported their companies will be buying more direct from manufacturers and less through distributors (see Chart 2). Just the opposite is true for about 16% of participants in the survey. The remainder, nearly 40%, reported no change in policy at their companies.

Why distributors?

The survey went on to ask about the single biggest benefit to companies from buying through distributors (see Chart 3). Not too surprisingly, the two most common responses were better service and better selection, each registering about 27% of responses.

When respondents were asked about the most important secondary benefit of working with distributors, better service and better selection again registered well, at 23% and 21%, respectively. Also at 21% was better delivery, while better market intelligence was cited by more than 16%. Neither better prices nor better terms scored high as either primary or secondary benefits.

A participant from a major eye-care product manufacturer admitted his company doesn’t often use distributors. Distributors are important to this company for “specialty items that we cannot easily find elsewhere, or where we don’t have the buying power to purchase directly.”

A large food processor in the Northwest uses distributor knowledge. “They are able to compare products before we spend money doing the same comparison. They are in contact with other manufacturers so they know what works best in most applications,” he said.

A major cosmetics company’s participant said that order volume is the key. “We purchase small quantities of foil for blister packaging [through distributors]. Going direct would be problematic.” The respondent from a water bottling company agreed, saying “another benefit is lower minimum orders.”

The survey also inquired whether distributors were up-to-date in order handling systems. Slightly more than half of the respondents admitted they didn’t know. Of the other half, the ratio was about 3:1 in favor of those who said distributors were keeping up-to-date vs those who said distributors were not keeping up-to-date.

Networking for research

The questionnaire asked a number of questions about how participating companies research products before purchases. For example, more than 86% reported using the Internet for this task, whereas slightly more than 10% said their companies did not.

When survey respondents were asked which of several specified methods was the most important to their companies, the responses were quite interesting (see Chart 4). Nearly one in five said that networking contacts is the most valuable research tool, while 17.6% said it’s packaging publications. Trade shows are close behind (16.5%), with Web sites following (15.9%).

This research appears to conclude that distributors remain a major part of packaging purchasing, but that use of distributors is definitely being eroded by increasing use of the Internet.