What we predicted: “The contract packaging industry is in the early stages of a massive wave of consolidation that will reshape the marketplace. Within five years, the market will resemble financial services, waste management, retail, and the automotive industries; a handful of companies will assert leadership over the contract packaging industry, and the gap between the ‘haves’ and ‘have nots’ will expand significantly. The core driver of this trend is the convergence of contract packaging and contract logistics. This convergence will accelerate as consumer packaged goods (CPG) companies seek to reduce their suppliers, as packaging and logistics companies seek to expand their scope of services, and as outside capital funnels resources to the most innovative companies.”

Four years later, with the economy beginning to get back on track after the Great Recession, the convergence of the two industries once again is picking up the pace. CPG companies that know very specifically what they want from their service providers, and those that are monitoring industry developments will be in the best position to develop long-term strategies that successfully leverage contract packaging and contract logistics services. The leaders will focus on either economies of scope or economies of scale.

To understand how and why these developments are occurring, let’s look back at the past four years, to focus on M&A and competitive changes. What has happened, and what do we expect to see over the next several years?

Contract logistics: Why it matters

The term “logistics” originally was rooted in the military as a description of the services required to feed, arm, and supply troops. Today, logistics also refers to warehousing, surface transportation, and freight-forwarding services. To reduce inventory, shorten delivery times, and pursue just-in-time business models, CPG companies have increasingly made logistics a vital part of their strategies. Contract logistics has been gaining in importance for the following reasons:

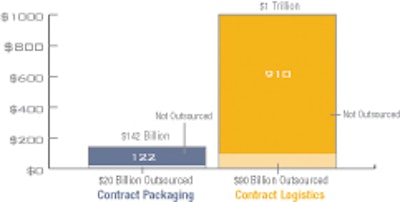

• Size. At $1 trillion, the logistics market is nearly seven times the size of the $142 billion packaging market. Sizes of these markets are plotted in Figure 1. The outsourced logistics market, in turn, is nearly a $100 billion market, much larger than the $20 billion contract packaging market.

• Growth. Based on its analysis and interviews with leading outsourcers, BG Strategic Advisors believes the contract logistics market has been growing at 15% annually for the past 10 years, faster than the 10% growth rate of contract packaging. Faster growth is partly the result of lower penetration, because only 9% of the U.S. logistics market is outsourced, compared with 14% of the contract packaging market. Another factor in cost growth is the estimated 15% to 30% cost savings companies can gain from outsourcing logistics versus handling logistics “in house.”

• Scope. The supply chain encompasses a broad range of services, including sourcing, air freight, ocean freight, trucking, rail service, warehousing, reverse logistics, supply chain technology, and a mix of other capabilities. Logistics companies can provide their customers with various services while gaining deeper points of integration with their customers.

This scope makes logistics companies increasingly valuable, compared with specialists that cover a narrower set of capabilities. In turn, top logistics providers are expanding their value to customers by cutting costs, solving a broader set of challenges, and delivering seamless supply chains. Of particular importance to CPG companies are contract packagers that can integrate their services with contract logistics.

Thus, due to larger size, faster growth, broader scope, and tighter integration, the logistics market wields disproportionate influence on its customers, compared with the packaging sector. Logistics will exert a disproportionate impact in the convergence between contract packaging and contract logistics. Increasingly, contract logistics companies have sought to expand into contract packaging. Examples include Jacobson-Wilpak, NFI-Quick Pak, Saddle Creek-ServiceCraft, and Saddle Creek-Copak. Why are these logistics companies pursuing packagers, and what are the implications? To address this question, we turn the spotlight on contract packaging mergers and acquisitions.

Contract packaging M&A: Key drivers

In the past four years, we’ve seen two types of mergers and acquisitions in packaging: deals focused on scale, and deals focused on scope. Acquisitions like Cloud Packaging-Toll Packaging and Ryt-way-Cloud represent the pursuit of scale. Three companies provided contract packaging services to the consumer goods sector. Although Toll focused on the pet food niche, all three companies offered similar services. The resulting merger created a larger category leader in the contract packaging sector for food companies.

In contrast, acquisitions like Jacobson-Wilpak represent the pursuit of scope. The two companies both served similar CPG customers. But in this case, one company specialized in contract packaging, while the other company specialized in contract logistics. The combined firm, Jacobson-Wilpak, became a solutions provider that offered broader scope than its competitors, resulting in a competitive advantage. What themes emerge from these acquisitions?

• The importance of national solutions. In the cases of buyers seeking both scale and scope, the underlying objective was to achieve a broader geographic footprint. For Ryt-way, the acquisitions of Cloud and Toll expand the company from its Minnesota headquarters into six locations in the Midwest. The resulting company, totaling more than $200 million of revenue, will provide a broad suite of packaging options, technological advantages, and category expertise for the packaging of a broad number of dry foods, including cereals, prepared meals, snacks, sweeteners, side dishes, desserts, dried fruit, nutraceuticals, and pet foods. For Jacobson, the acquisition of Wilpak brought the Des Moines, IA-based company into Atlanta, and accelerated the company’s expansion into more than 100 locations across the United States, with in excess of 30 million sq ft of space. Today, Jacobson is now one of the 10 largest outsourced supply chain companies in the country. Further, more than 20 of its top 30 customers take advantage of Jacobson’s broad scope and use more than one of its services, validating the convergence strategy.

• The role of outside capital. For both Ryt-way and Jacobson, outside capital fueled their expansion. Ryt-way is backed by Wind Point Partners. Jacobson is owned by Oak Hill Capital. In both cases, outside capital has enabled management teams to accelerate their growth via acquisition. With more than $200 billion in private equity capital still sitting on the sidelines, this factor will only increase in importance as other companies seek to merge.

• Early stages, with a busy 2011 anticipated. In each example above, the buyers have committed to an acquisition-led growth strategy. As a result, we can expect to see these and other buyers pursue a larger number of acquisitions in the coming years. Jacobson has acquired nearly a dozen companies. NFI has purchased even more. These firms will continue to fund buyouts, because they recognize the importance of economies of scale and scope. Further, more aggressive buyers are entering the market, and they will likely outbid the traditional buyers because of the increased strategic value they attach to gaining a platform.

These drivers have led to a significant number of contract packaging transactions during the past four years, a selection of which are set forth in Figure 2.

Future implications

So, what can we expect for the future of the contract packaging sector? How should contract packaging service providers respond? And how should CPG company service buyers of packaging services take action?

For contract packaging providers, the central question is this: how do you ensure you are positioned for success? If your competitors are teaming up with contract logistics providers to achieve broader scope, or merging with other contract packaging service providers to achieve larger scale, how will you respond? Should you consider adding capabilities and locations? Are you better off buying, selling, or standing pat?

For CPG companies, the primary objective is to recognize these forces, and determine how to anticipate your strategy. Can you form longer-term partnerships with your contract packaging service providers? If they add contract logistics, can you manage your total supply chain more effectively, resulting in lower cost, faster responsiveness, and superior results?

Ultimately, the best contract packagers are going to respond to the marketplace need. Smart packagers will either pursue economies of scope or economies of scale. Smart CPG companies will demand these benefits from their suppliers. And those that fail to adapt will lose market share to their more aggressive competitors. Which one will you be?

The author, Benjamin Gordon is CEO of BGSA, an investment banking firm for the packaging and supply chain sectors. Contact Benjamin at [email protected], or at 561/932-1601.