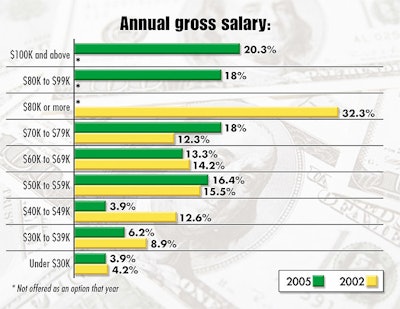

Six-figure annual salaries are earned by 20% of packager respondents to Packaging World’s 2005 Salary Survey, conducted earlier this year on PW’s Web site, Packworld.com.

In fact, nearly 58% of respondents reported salaries of $70ꯠ or more, up from the 45% who reported that level during PW’s last salary survey conducted in 2002 (see Chart 1). That’s good news considering the uncertain economy, corporate consolidation, and job-security concerns. Nearly 30% earned between $50K and $69K, virtually the same as in 2002 (see packworld.com/go/c141). Only 14% made less than $50K.

Three years ago nearly 26% of respondents fit into the under $50K group. These incomes compare favorably to the $49겪 median annual salary for a typical packaging engineer according to Salary.com, a compensation management firm based in Needham, MA.

Experience appears to be a key factor in the strong salaries reported this year. Asked how many years they’ve worked in a packaging capacity, 11.5% responded with 11 to 15 years, while 31.5% indicated more than 15 years, and another 22% indicated they had six to 10 years of packaging experience.

More than six of 10 respondents said they are working about the same number of hours to earn their pay compared to a year ago, although one-third replied they were working more hours. Only 6% said they put in fewer hours this year than last.

Despite their salary levels, many survey respondents voiced job concerns (see sidebar). Not surprisingly, as workers climb the corporate ladder and their incomes rise, they feel more vulnerable. “I feel I have spent 24 years achieving my status, and now I’m [considered] overpaid and not qualified for advancement,” said a packaging engineer with a meat products company in Canada.

A purchasing agent with four years of college and between 11 and 15 years of experience noted, “I have reached the top end of the salary range.” He works for a company that packages graphic arts and photographic products in the Southeast.

Factoring in job satisfaction

Company and product sales played the most critical role in determining income, according to one-third of salary survey respondents. Personal production or output was cited by 23%; relationships with management or supervisors (18%) and general economic issues (17%) were also frequently mentioned.

Packworld.com’s survey asked which job factors were viewed as most and least satisfying. On the positive side (see Chart 2), 41% selected decision-making autonomy, 21% said job security, 18% said salary, 11% replied number of hours worked, and 9% noted advancement potential.

Respondents listed advancement potential (29%) as the least satisfying job factor. Number of hours worked followed at 20%, with 18% saying job security, 17% decision-making autonomy, and 16% salary.

Job satisfaction is clearly being influenced by management decisions. An industrial engineer with a Midwest maker and packer of electrical equipment believes, “Most American companies are looking for a fast buck and are not concerned with an individual employees’ long-term career.”

A 50-something purchasing agent at a chemicals producer in the Southwest offered the following scenario: “Our company has restructured four times in the last three years. The facility I work for has reduced headcount from 1겨 to 450 in less than five years. There are constant rumors of further reductions. Shedding nonvalue work and prioritizing work are delicate and political matters. This adds to stress and potentially affects performance.”

There was no satisfaction in a response from a production and operations manager at a Midwest food company. “We’re continuing on a downward spiral of more hours, weekends included, and no time with family,” said a man in the $70ꯠ-$79ꯠ annual salary range. “There’s been no salary increase for three years, and with no increase, the 401(k) does not increase and pension levels stay locked. Plus healthcare co-payments continue to rise.”

Benefits, of course, figure strongly into job satisfaction. Medical insurance was selected as the most important benefit, by 43.5% of respondents. A 401(k) or similar plan was mentioned by 18.3%, a pension plan by 10.7%, and a yearly bonus by 8.4%.

Comparing past years

Looking at the past 12 months, most 2005 survey respondents (38.9%) said they received a salary increase of 3% to 4.9%, much the same as in 2002 (see Chart 3). Raise comparisons between the two years reveal mixed results. In 2002, more than 21% of respondents said they received no increase in the past year. This year, only 14.5% reported no increase. That’s the good news. The bad news for 2005 respondents: Raises of 5% or more declined. Additionally, 1.5% of this year’s respondents saw their income head south; “pay was reduced” was not an option in the previous survey.

“Income is not keeping pace with inflation,” suggested a packaging engineer with a chemicals packager in the Midwest. “Maximum salary increases of 4 percent or less is not practical when gasoline, natural gas, water, phone, and electricity costs are increasing between 12 and 20 percent.”

Comparing the business climates for the year preceding the two surveys shows similar figures. The most frequent change mentioned by respondents in 2002 and this year was “adding more responsibilities without more pay” (see Chart 4). The most noteworthy difference between the two surveys was the percentage of cuts in packaging-related budget (15.5%) and staff (13.6%). In 2002, those figures were much smaller. It is important to realize, however, that 2005 respondents could check all answers that applied, as opposed to three years ago when they could select only the most appropriate response. The same caveat could apply to numbers showing that slightly more respondents indicated they switched jobs or companies, or were promoted this year, than in 2002.

One question asked this year but not in 2002 was, “Has your company hired more part-time, seasonal, or temporary workers in the past 12 months than in previous years?” Forty percent answered affirmatively. Of these, the main reason for more part-time hiring was to meet seasonal demand, said 56% of respondents. Thirty-seven percent indicated the reason was to replace full-time workers, and 15% said their companies hired workers to help bring a package to market. (Multiple responses were permitted.)

Based on this year’s salary survey responses, it appears that loyalty between employers and employees may be eroding as profitability pressures continue to rise. Workplace stress and job-security concerns also continue to mount. Working packaging professionals continue to contribute in industries faced with many global challenges. You’re pulling down a handsome paycheck—but earning it!

See sidebar to this article: Survey methodology

See sidebar to this article: Respondents serious about job security