Modifications to plants and packaging lines, using equipment that accommodates short runs and quick changeovers, and strengthening primary and secondary packaging, all represent changes that can help packagers fulfill e-commerce orders shipped direct to consumers. Those were among the key recommendations from 215 online visitors (see “Methodology,” p. 79) responding to a survey on Packworld.com late last year. Some 38% of respondents to the “E-commerce, direct-to-consumer” survey said their companies were already selling products over the Internet. Many said their companies would begin to sell online in the future, either within one year (18%) or three years (9%). Another 24% didn’t know whether their company’s goods would be marketed in cyberspace. The remaining 11% declared they’d never sell products electronically. (For a report on survey respondent comments, see story, p. 80).

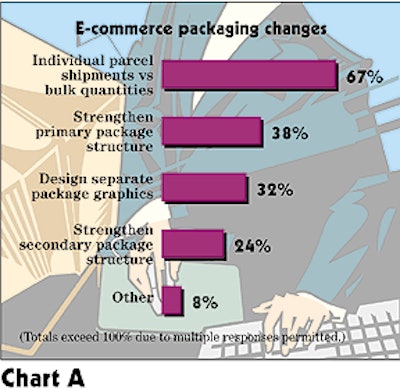

Changes in the wind The real meat and potatoes of the survey centered on two questions: What kind of package changes will be necessary for e-commerce, direct-to-consumer sales, and what kind of machinery changes will be necessary to accommodate packaging for such sales? For both questions, respondents could check any or all of several possible changes, and indicate other changes the questionnaire did not list. The survey question regarding package changes drew 106 responses from 63 respondents, who were allowed to check multiple answers. As expected, the majority of answers indicated that the most prominent change for e-commerce—cited by 67% of respondents—was shipping products individually via parcel vs in bulk quantities (Chart A). The next-most frequent response was the need to strengthen primary package structures to handle the small-parcel shipping environment (38%). That was followed closely by 32% of respondents who believed that separate package graphics will need to be designed for packages sold online. Another 24% believed that secondary package structures will require strengthening, while 8% cited “other.” Again, the percentages to this question exceed 100% as respondents made multiple choices. Multiple choices were also permitted concerning the question of changes in machinery, where 57 respondents provided 81 responses. Modifying plants and packaging lines was the most frequently mentioned change, cited by 44% of the online respondents who answered the question (Chart B). Another 30% mentioned the need to purchase equipment for short runs that permits fast changeovers. E-commerce fulfillment would require contract packagers or other outsourced services, according to 28% of respondents to this question. Other suggestions included the need to set up packaging lines specifically for Internet orders (19%) and to invest in new plants (11%). Survey respondents were fairly strong in their belief that e-commerce orders would require a financial investment. As a chart in last month’s issue indicated, 47% of the 66 people responding to a question concerning e-commerce packaging expenditures believed costs would increase. Almost as many (42%) felt costs would remain the same, while only 11% expected costs to fall (see Jan.’01, p. 2, or packworld.com/go/costs).

Additional factors The survey questioned current and prospective online sellers by asking if at least some changes will be required in how they package those products (Chart C). A full 41% of the 184 respondents to the question said no, while 29% answered affirmatively. The balance did not know. Of the companies selling or planning to sell product to consumers via the Internet, the leading channel through which such sales would be conducted is respondents’ own sites (79%). Online versions of traditional stores such as Wal-mart.com would also sell respondents’ products (29%), and “pure-play” online sites, such as Amazon.com, will be used by 15% of respondents. Again, multiple answers were permitted to this question. Asked if a person or group would be responsible for manufacturing/ packaging of e-commerce orders, the majority of respondents said no (44%), or don’t know (29%). However, 27% responded affirmatively. That would likely indicate management’s sincerity to generate e-commerce sales. Overall, the survey responses seem to indicate that fulfilling e-commerce, direct-to-consumer orders will require some investment, be it in equipment, materials or in the plant itself. These investments carry risks. Add the reports of struggling or failing “dotcoms,” and the perceived risks escalate. Still, this survey shows that many companies have stepped to the e-commerce direct-to-consumer plate or have at least moved into the on-deck circle.