The corrugated case is the one form of packaging that nearly all companies use to ship their products. Thus, it's no surprise that corrugated paper price increases have the most widespread effect across the wide swath of purchasing executives who buy packaging.

Other materials, especially paperboard and plastic films and containers, have also registered price increases that are troubling to packagers. In fact, only glass and metal containers, both steel and aluminum, are largely escaping the finger-pointing by purchasing people as contributing to higher product prices.

These are the highlights of an exclusive mail survey on packaging material pricing conducted in late spring by Packaging World and Market Research Support Services (MRSS), a consultant based in Roselle, IL. Despite the touchy subject, over 18% of 1겨 questionnaires were returned. This report is based on the information supplied by nearly 220 responses.

The survey was sent to a sample of purchasing executives who subscribe to PW. Of the 220 responses used for this report, some 55% came from executives at companies in the food industry, 35% from people in the chemical and pharmaceutical businesses, and about 6% were identified from companies that make medical and dental instruments and supplies.

Is the topic controversial? It appears so. In spite of our assurances of confidentiality, and offering respondents a chance to win a handsome prize for returning the survey, several questionnaires were returned without the address label that was needed to qualify for the prize drawing.

Even with several unidentified responses, MRSS tells PW that the results are considered statistically valid to within ±3%, based on the magazine's circulation to purchasing executives.

Are packaging material price increases important to purchasing people and their companies? The accompanying sidebar reveals that half of the respondents (49.7%) say that increased packaging prices will have a noticeable or significant effect on their company's sales this year and next. More than nine of ten say the effect will be negative.

Earlier this year, according to a report published by the Flexible Packaging Assn., a survey of the top 50 food and beverage companies by Food Business magazine suggested that prices now play a minor role in those firm's selection of vendors. Given a list of nine vendor product and service attributes, long-term pricing finished third, well behind product quality and on-time delivery. Short-term prices finished eighth in importance. Just 26% of the respondents viewed price as a more dominant factor than in the past.

However, this survey covered all vendors, not just those that supply packaging, and it was conducted six months before PW's survey. Timing may be everything when you ask about price situations.

Taking the heat

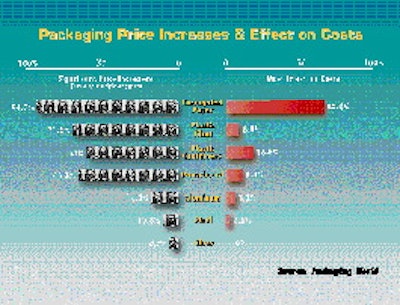

PW asked the purchasing people to select which of seven packaging material or materials had registered "considerable" price hikes in the last year (Chart 1). Most respondents cited more than one material, some as many as five. As expected, corrugated costs were cited by almost all respondents, 94.7%. The other paper category, paperboard, was noted by about two-thirds of respondents, or 66.3%.

Plastics, both rigid containers and films, were also identified as materials that showed considerable increases. Plastic film prices were up considerably for 71.2% of the survey respondents; plastic containers were noted on 62% of the responses.

Aluminum, steel and glass packaging price increases were noted by far fewer respondents. Only 16.8% of responses mentioned aluminum prices up noticeably, 10.6% mentioned steel, and just 6.7% said glass container prices were up considerably.

Separately, we asked which one material had affected their company's costs the most. Here's the best news for the glass industry: not one respondent indicated that glass price increases affected costs the most! Only 1% said steel, and aluminum was cited by only 3%.

Corrugated prices was again the "winner." Some 65.3% of respondents said that corrugated increases most affected their costs. Plastic container costs was selected by 16.8%, while 7.4% chose plastic films and 6.4% said paperboard.

Half on allocation

Tightened supplies of some materials, particularly plastic resins, has been a major issue in the marketplace, and a subject of some discussion between raw materials producers and package manufacturers. Obviously, it also affects container purchasing, but perhaps not as much.

When asked about which packaging materials have been on allocation over the last six months (Chart 2), 43.5% of respondents said they were buying at least one material under an allocation program from vendors. Still, more than half of the purchasers responding to our survey had not experienced buying restrictions in the last six months. A few participants indicated that allocation programs are expected later this year.

Allocation programs for corrugated were mentioned by 28.2% of all responses. But of those who had experienced allocation, this represented over 46%. Paperboard was cited by 11.5% of all respondents, and 18.8% of those who bought any materials on allocation.

Buying plastic films on allocation was indicated by almost the same numbers, 11% of all responses; these represented 18% of responses on allocation. Restricted purchasing of plastic containers was noted by 7.7% of all participants, 12.5% of those on programs.

Only a handful of responses indicated any allocation programs for steel, aluminum or glass packaging.

Prices divorce partnerships?

It appears that the combination of higher prices and restrictive buying programs has resulted in less loyalty between companies and packaging vendors. Other factors are also probably factored in the mix as well. In our survey, fewer than half the respondents said they had not changed packaging suppliers in the last six months (Chart 3).

Here, despite the overwhelming impact of corrugated prices on purchasers, vendor switches were common in other materials, too. Glass, steel and aluminum packaging purchasers were considerably more loyal than those who buy paper and plastics. Of all the respondents who report vendor changes in the last six months, fewer than 8% of those changes were for glass, steel or aluminum suppliers.

Of all respondents, 31.1% said they had switched vendors of corrugated in the last six months. Changing corrugated suppliers represented 37.1% of all vendor changes noted. Purchasers changing suppliers of plastic containers totaled 16.7%, and 14.8% had switched vendors for plastic films. Paperboard accounted for 13.4% of vendor switches.

Some 20% of survey participants said they had changed suppliers for the same material more than once in the last six months. Of these, 44% changed more than once in corrugated, 19.2% in plastic containers and the same percentage for films, and 7.7% changed paperboard sources more than once in the previous six months. A total of 10% reported more than one change in the combination of steel, aluminum and glass packages.

It's important to note that many respondents reported vendor changes in more than one packaging material. Observe, too that over 46% of survey participants didn't report changes in suppliers in the last six months. It may be that pricing and tight supplies of materials have, in part, suspended the emphasis on creating partnerships between packaging suppliers and their customers.

Why the changes?

The short answer to why such changes might have occurred is high prices. We asked purchasers which of four reasons was the primary cause for changing vendors. Prices that are too high was the most frequent answer for all of the materials.

For purchasers who changed paperboard suppliers, high prices was the primary reason at 84%. Lead times that were too long was the primary reason for 12%, and allocation programs were mentioned by the remaining 4%. In corrugated, the ratios were about the same. Prices were the cause 71.4% of the time, lead times were cited 14.3% of the time, and allocation programs were blamed for 10.7% of the changes. A vendor going out of business was the reason 3.6% of the changes were made.

In plastics, pricing was the primary cause 71.4% of the time for films, 82.1% in containers. Order lead times was the problem for film buyers 21.4% of the time, just 14.3% of the time for container purchasers. Allocation programs accounted for 7.1% and 3.6% respectively.

Of the relatively few vendor changes in glass and in aluminum packaging, long lead times was mentioned about a third of the time. For steel container buyers, 25% of vendor changes was said to be caused by being put on allocation.

Specs change too

Along with switching supply sources, packagers have often changed packaging specifications to try to dampen the effect of price increases. More than half of all respondents report changing specifications on one or more materials (Chart 4).

It's likely that price hikes and the widening availability of edge crush standards in specifying corrugated combined to make corrugated the material most often changed. Some 40.2% of all respondents reported changing specs for corrugated. Similarly, new materials and converting technology probably also had an effect, along with prices, to direct 17.2% to change specs on plastic films. Downgauging is another factor that likely played a role in changes of specs.

Despite the price hikes on paperboard, just 12% of respondents say they changed their specifications. The same is true for plastic containers. Only 11.5% of purchasers report a change in their specs.

Like the other questions, very few participants reported changes in specs for steel, aluminum or glass. It seems there is a strong relationship between higher prices and switching vendors or changing material specifications. Since steel, aluminum and glass container prices haven't noticeably affected purchasing agents and their companies, there is little impetus to look for other sources or to change specs.

Three of four respondents report that they instigated the changes of specifications. Just 26.3% credit the vendor with suggesting the change. This varies a bit by material. Of paperboard spec changes, the vendor suggested the change about a third of the time. In plastic films, the vendor is credited 36.4% of the time, and consultants are credited 3% of the time.

Some substitution

The final strategy we studied in purchasers' struggles to cope with high packaging prices was material substitution. As certainly the most radical response, switching materials was reported by only about a third of all respondents (Chart 5).

Of the 90 responses of material substitutions, corrugated was the primary material that was changed, at 41.1%. Both plastic films and plastic containers each made up 17.8% of those that switched materials, while paperboard was close behind at 16.7%. Once again, steel, aluminum and glass were seldom changed. The three materials total only 6.6% of material substitutions.

We encourage these figures to be viewed with caution. We asked about situations where price increases caused purchasers to "switch from one material to another material," and only asked respondents to specify the material they switched from.

Of those 17.7% of all responses who said they switched away from corrugated, what is it likely they switched to? Certainly corrugated used for inner packing has some alternatives in other materials. But in the case of the corrugated shipping case, alternatives are less clear. Unless, of course, the respondent was reporting on a switch from 250# C-flute to 33 EC or to 200# B-flute. If so, that was the change we had in mind when we asked about changes in specifications, not in materials.

On the other hand, changes in plastic films or containers, from one resin to another, is exactly what we were looking to document.

In Part 2 of this pricing study, we'll examine the effects of packaging cost increases on product costs and on packaging operations.