The Flexible Packaging Association (FPA), the leading trade association for converters of flexible packaging and suppliers to the industry, recently commissioned a Brand Value Study to better quantify the impact flexible packaging can provide for brand owners. The first-of-its-kind study integrates primary research of consumers, brand owners, and industry members, plus input from secondary research, into one report. The research includes insights from 304 brand owners surveyed online in August 2015 by Packaging World magazine, opinions from 2,120 consumers surveyed online in September 2015 by Harris Poll, and projections from FPA members interviewed by Gibbs-rbb Strategic Communications in 2015.

Key findings include:

• Flexible packaging fits contemporary lifestyles and retail trends

• Packaging has a positive, documented impact on brand value

• Consumers are willing to pay premium prices for certain product attributes enhanced by flexible packaging

Enhancing brand value

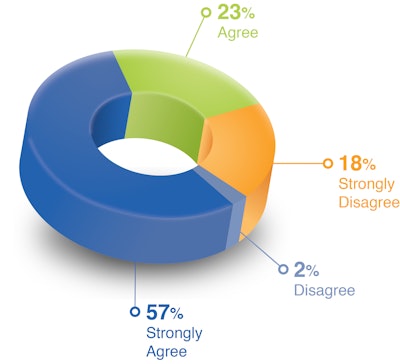

The positive impact packaging has on brand value is well known by most brand owners (food and CPG companies). In the FPA-commissioned survey of brand owners conducted by Packaging World, 57 percent of respondents said they “strongly agree” with the statement that “packaging has an influence on my brand’s value” while an additional 23 percent “agreed” with the statement (Figure 1).

The brand owner respondents represent a cross-section of key decision makers from companies in food, personal care, healthcare, and packaging/design consulting.

Brand owners surveyed by Packaging World were asked to select which three stakeholders are most likely to influence their choices of packaging solutions (Figure 2). Knowing the importance packaging has on brand value, marketing and brand managers were mentioned as most influential. Consumers were mentioned by more than half of respondents, while one in three said packaging suppliers were most influential when choosing a packaging solution.

Also in the Packaging World survey, brand owners were asked to choose the three most important attributes of flexible packaging (Figure 3). Two of the top five attributes were tangible aspects while three of the top five were intangible brand factors. Brand owners were then asked to identify which attributes they think are most important to consumers (Figure 4). By far the most important attribute selected by brand owners was “ability to reseal,” which was listed by almost two out of three respondents (who could choose up to three answer choices).

Preferences reported by consumers (Figure 5) and those predicted by brand owners were mostly consistent. Two exceptions where brand owners underestimated consumer value were “easy to store” and “easy to carry.” Considering the rise of snacking and consumers’ general desire for convenience, it’s no surprise that these two features are desirable packaging attributes.

Other highly rated attributes among consumers included “ability to reseal,” “easy to open,” and “ability to extend product life.”

Brand owners often integrate packaging solutions with product attributes that project a specific image to consumers. For example, brand owners are designing value-added features such as resealable closures and windows to enhance the “premium product” image and differentiate from competitors.

Do consumers notice packaging?

Like advertising and other marketing, the impact of packaging design on purchase decisions is not always obvious to consumers. But they do notice packaging. In the Harris Poll survey of consumers, 81 percent of respondents said they “always,” “often,” or “sometimes” notice when a product appears in a new or different packaging. In the same survey, 39 percent said they “always,” “often” or “sometimes” buy a product specifically because of new or different packaging.

In addition, 81 percent of consumers admitted to “always,” “often” or “sometimes” buying products they weren’t planning to purchase. These impulse buyers are more likely than people who never/rarely make impulse purchases to place higher importance on ability to reseal, extending product life and ability to see the product.

Commanding a premium price

Premium quality products, often coupled with desired packaging options, generally command a premium price at retail. The Packaging World survey asked brand owners how much of a premium they thought consumers were willing to pay for certain packaging attributes (Figure 6). Brand owners thought functional attributes—ability to reseal, ability to extend product life—would be considered by consumers to be most valuable. More than 40 percent of brand owners predicted the two attributes would fetch at least a 20 percent premium.

For which attributes are consumers willing to pay more?

Consumers said in the FPA survey conducted by Harris Poll (Figure 7) they would be willing to pay the highest premiums for tangible functional benefits such as “ability to reseal,” “ability to extend product life,” “easy to store,” and “easy to open.”

These specific attributes were each stated to be worth a premium price by over half of respondents. The average price premium consumers said they were willing to pay was as high as 14 percent for the top attribute, resealability (this percentage includes respondents who said they would pay 0 percent more).

Satisfying demanding consumers

In the Packaging World survey of brand owners, 97 percent of respondents who currently use flexible packaging indicated they planned to use the same amount or more in the next five years. Sales growth is expected across a range of product categories. Said one FPA member: “The future of flexible packaging is very exciting. We are not limited by a given mold, a certain shape, or even a specific use. We will continue to see growth.”

Packaging innovations must be consistent with broader corporate sustainability goals including general waste reduction and transportation efficiency—among others. Brand owners want to highlight innovative packaging features and attributes, while also having the ability to say their packaging is sustainable. Flexible packaging does both since it is material-, energy-, and transportation-efficient.

An open-ended question in the Packaging World survey, “what innovation would you most like to see in flexible packaging,” elicited responses including frequent mentions of recyclability factors. However, a similar question, “what are the greatest barriers to your use of flexible packaging,” generated far fewer responses on recycling. It seems that while recycling is not currently a hindrance to adoption, the industry’s continuing efforts to make flexible packaging materials and designs more easily recyclable by consumers could pay dividends in the future.

In the FPA survey conducted by Harris Poll, younger consumers tended to place higher importance (and value) across a range of packaging attributes than did older consumers. One particular disparity in age groups is seen within the environmental implications of their packaging purchase decisions. However, many consumer participants seemed to recognize that flexible packaging was holistically “better for the environment” than other packaging types.

Fast, fresh, and on-the-go

In FPA member interviews, many focused on the trend for today’s grocery shopper to place “tonight’s dinner” at the top of their list. The marathon grocery run has been replaced by daily dashes where freshness and convenience are top features consumers report wanting in food packaging.

In supermarkets, many consumers are paying a premium for fresh food kits or frequenting “grocerants”—part restaurant, part supermarket—for fresh pre-cooked entrees and sides. Deli and fresh-serve foods like rotisserie chicken are becoming more mobile as supermarkets shift from rigid domed containers to flexible pouches with handles that stay cool and make it easy to grab-and-go.

Consumers are also circling the supermarket perimeter for fresh snacks over typical crackers or chips. On-the-go yogurt drinks, non-dairy smoothies, and organics are in an explosive growth phase.

Instead of a rigid container of store-made cookies, supermarkets are packaging cookies three-to-a-pouch at a premium price. Single-serve packages flourish in center aisles as time-stressed consumers demonstrate a willingness to pay more for pre-packaged portion control.

Flexible packaging serves up what today’s consumer desires: health, wellness and convenience. Delivering on these not only enhances brand perception, it also supports premium price points for premium products.